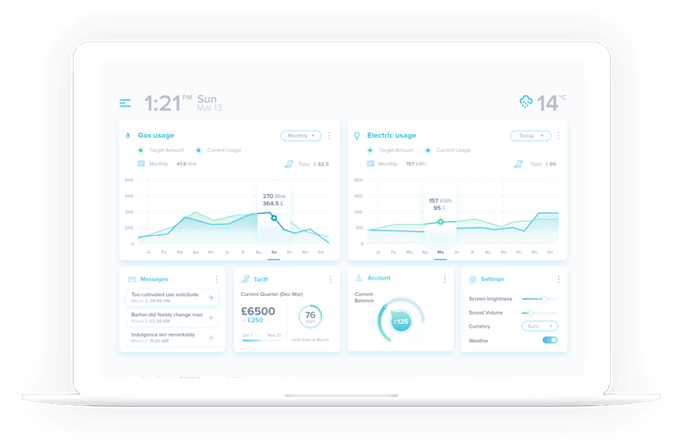

Once you sign up as a borrower, you’ll be able to create the basic details of your debt requirement for the lenders to view based on various filters. You, as borrower will also be able to upload the documents which are important for the lenders to take decision on your proposal.

Lenders will be able to view and express their interest in your loan proposal. More than one lender can express their interest in your loan proposal.

You can either accept or decline the interest of any or all the lenders. In case you accept any interest of any lender, you will be assigned a Relationship Manager from BankLoan, who will connect you with the lender for a face-to-face or virtual meeting.

The Relationship Manager will always be available to you for any support. You will be able to track your loan proposal at every stage till disbursement the loan on BankLoan.

You may send a mail to escalate any issue at info@bankloan.com